Industry News

Business Models for China’s Cross Border e-Commerce Market

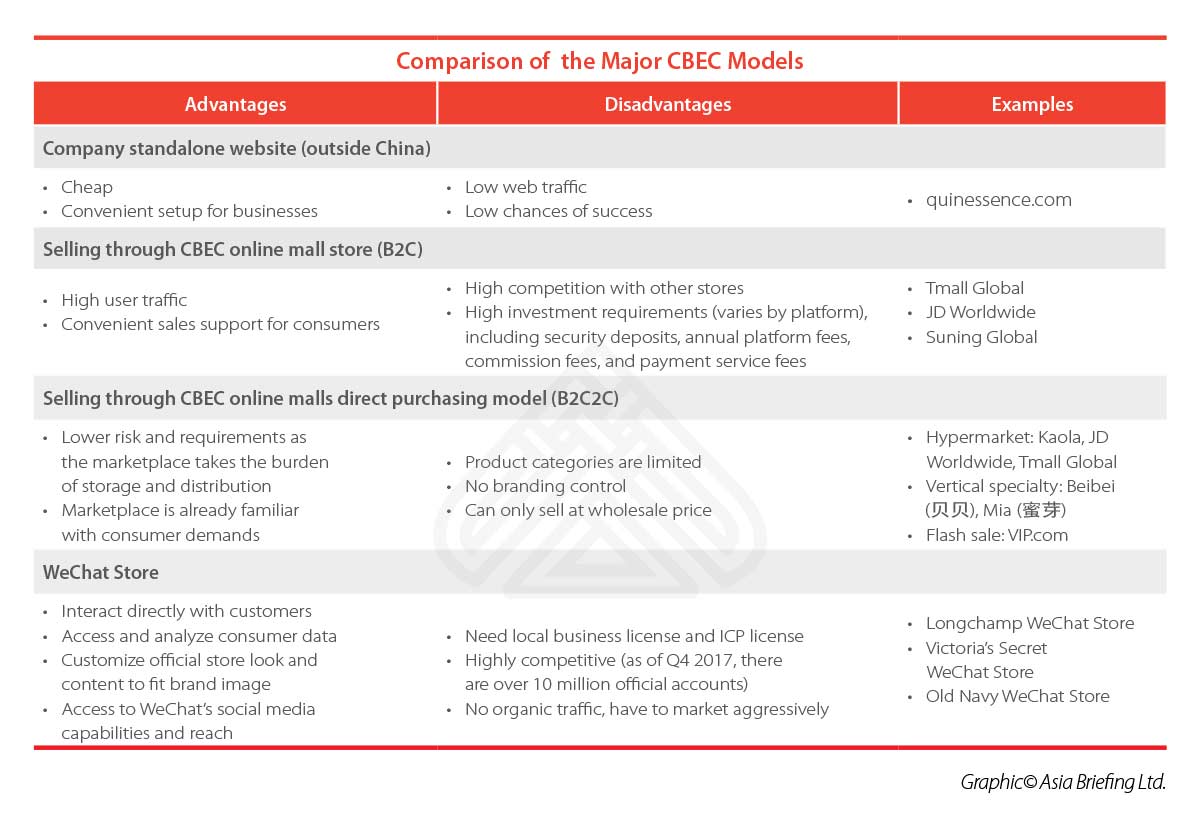

Foreign businesses that want to access the Chinese cross border e-commerce (CBEC) market first need to choose their model. Due to the varied nature of CBEC models and platforms, this can be a challenging endeavor, particularly for those unfamiliar with the Chinese market.The final decision depends on a strategic analysis of each model, and a breakdown of the main advantages and disadvantages facing the company.

Major CBEC Models

In this section, we outline the four models that foreign business may choose in order to do CBEC in China. These models are the methods in which investors can sell in China, either directly to consumers (B2C) or indirectly to consumers through a marketplace intermediary (B2B2C). Consumer to consumer selling (C2C) is excluded as C2C model is primarily carried out by a purchasing agent or“daigou”(代购), and not a formal business.

Company standalone website (outside China)

Many companies are attracted by the idea of having their own standalone website hosted outside of China. At first glance, this option appears to be the most convenient as it does not require a legal Chinese entity and is cost effective.

However, these websites often have low web traffic and interest from potential consumers. This is due to three main reasons.

First, if the website is hosted outside of China, Chinese consumers may not even be able to find or access the site. Secondly, there is already intense competition for Chinese consumer traffic waging between the giants of e-commerce in the country. Finally, these standalone websites often fail to provide customer supports that Chinese consumers demand, such as refunds, exchanges, Chinese payment methods (UnionPay, WeChat Pay, AliPay), after sales support, reliable delivery, and more.

Selling through CBEC online mall store (B2C)

Online malls are marketplaces that act as a centralized platform for different “stores”. Each brand can have its own store and operate it themselves. Consumers can purchase items from stores using the online mall’s checkout system.

This model has grown in user popularity as it is convenient and reliable for the consumer. The consumer can access a number of different stores, allowing them to “shop around”. Additionally, the single checkout system uses a familiar payment method (AliPay or WeChat Pay). Finally, the online malls allow consumers to talk directly with the shops, and offers easy and fast sales support.

Selling through CBEC online malls direct purchasing model (B2C2C)

In the B2B2C model, foreign businesses indirectly reach Chinese consumers because there is an intermediary marketplace where products are sold. There are three main intermediary marketplaces: hypermarkets, vertical specialty, and flash sales.

Hypermarket

In a hypermarket, there is only one shopfront. The hypermarket itself purchases goods directly from the overseas company, and adds it to their product stock. The product is then sold on the platform with a retail price.

Additionally, the goods are stored and delivered through the hypermarket’s own warehouse and distribution centers, reducing the logistics burden for the foreign brand. The foreign brand need only deal with the procurement manager with whom they can negotiate prices. Often, the hypermarket focuses on particular categories of products, such as wine, handbags, or milk powder.

Vertical specialty

Like hypermarkets, vertical specialty platforms also buy goods directly from the overseas supplier. However, these platforms focus on niche product categories, consumer demographics, or regions. Vertical specialty platforms are growing quickly as their niche focuses target potential customers better and leads to higher sales conversions.

Flash sale

As the name suggests, flash sale platforms offer limited quantities of products at discounted prices for a short period. Often, the goods are new to market, or surplus products. Flash sale platforms offer foreign brands the ability to market their goods in the Chinese market, or even to test out the popularity of various products.

WeChat Store

WeChat and WeChat Stores are an emerging CBEC method, but unlike the aforementioned models, it is primarily a social media app with related services. Despite this, its growing popularity and CBEC implications make it an attractive option for many foreign brands.

WeChat, originally a messaging app released by Tencent, has become a superapp – one that virtually everyone uses in China. Its functions have grown to include WeChat Pay, which allows users to pay their bills, order food and taxis, book appointments, buy tickets and more. WeChat Pay is now one of the leading payment methods in China, with almost 900 million active users.

Once a company has a verified account, it can open an in-store app through which it can sell directly to Chinese customers. The customers can then use WeChat Pay to buy the products.

As Chinese customers often get product recommendations through social media, the WeChat Store is a potentially powerful model.

Additionally, through the chat capability, brands can interact directly with the consumer. Finally, the brands can also access consumer data, which allows them to improve their services, products, and image.

In order to open an official WeChat account, companies are required to provide a local business license and an ICP license. Foreign firms can get around this requirement by either engaging a local party or a third-party agent, or engaging a local third-party WeChat e-commerce platform like WalktheChat.

Platforms comparison

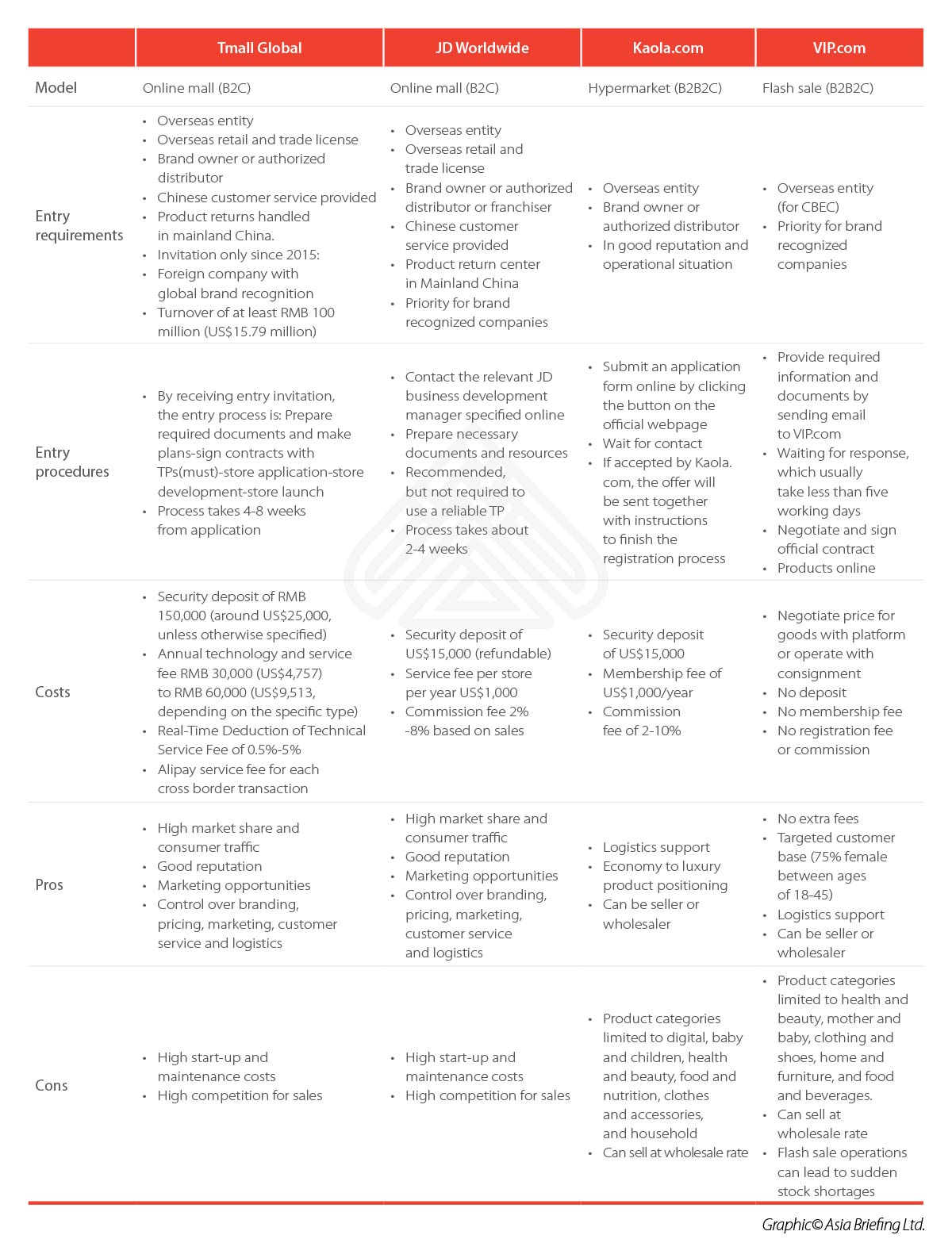

As the variety of existing CBEC models suggests, CBEC platforms are proliferating in China, and growing beyond the mainstays of Tmall Global and JD Worldwide. To be noted, with competition getting tougher and tougher, major platforms tend to use mixed models rather than one. For example, Tmall Global is traditionally focusing on online mall (B2C) model, but with direct purchasing model gaining great success, it launched its own direct purchasing channel as well. Kaola.com, originally focusing on direct purchasing (B2B2C) model, also expanded its business to allow third party stores entering its platform.

Entry strategy advisory

The options described above are just a small sampling of platform that foreign brands can choose from. The best-fit platform for a company should be based on a number of different considerations, but the main decision-making points include:

Product

Depending on the product, it may be advantageous to consider an array of specialty websites, like Beibei (for babies and children) or Yiguo (fresh foods), or others.

Funding

Some platforms, like Tmall Global and JD Worldwide, offer high growth prospects, but also require high startup and maintenance fees. Other platforms have lower fees, but slower growth prospects.

Market development plan

The platform will have a major impact on the brand and product’s image and branding in the market. Therefore, the platform (and model) has to be integrated into the market development plan.

Regulations and operations

Some platforms require a business to have more Mainland China capabilities. For example, Tmall Global and JD Worldwide require companies to have product return centers and Chinese customer service capabilities.

Of course, companies do not need to be married to one platform; they can pursue a multi-channel strategy. In this case, the investors should consider how the different platforms fit into their overall e-commerce plans, and overall market entry strategy.