It’s no surprise warehouse processes have grown more complex in the on-demand economy. Greater demand and higher customer expectations mean employees must move product through the warehouse as efficiently as possible.

Warehousing technology has evolved to meet these challenges, helping employees better track inventory through the receiving and put-away processes. While these advancements address concerns within individual warehouses, they don’t provide a solution for tracking inventory throughout the supply chain. Manufacturers needed a standard system to guarantee they’d have complete visibility into shipments as they arrived.

That’s why manufacturers in industries such as food and beverage turned to GS1 standards. GS1 is a not-for-profit organization that maintains standards for business communication.

GS1’s leadership in barcode innovation stretches back more than 40 years, but we’ve yet to achieve universal adoption of GS1 standards. Even some warehouses that work with GS1 standards maintain redundant barcoding processes.

Greater adoption of GS1 standards could transform the way we work with barcodes and help warehouse managers achieve maximum efficiency.

Barcodes: A step forward—but how extensive?

It wasn’t long ago that most warehouses relied on manual inventory processes. Trucks would arrive, workers would take stock using pencils and paper, and items would be placed on the shelf. For managers, however, these processes were headache-inducing: If one employee recorded a wrong number while receiving stock, the consequences would ripple across the warehouse.

RF scanners erased much of the manual burden—staff could scan a barcode rather than relying on a physical record. By adding an extra set of “eyes” to the receiving and putaway processes, warehouse operators were able to achieve higher levels of inventory validity.

Still, because these barcodes contained little information beyond item listing, it was entirely possible employees could miss inventory or count it incorrectly. Supply chain innovators have introduced various solutions for the issue; for instance, advanced shipping notices provide recipients with critical inventory information, giving their team greater visibility into what stock, and how much, should arrive.

However, GS1 standards deliver the same information—and because some of the world’s largest industries follow these guidelines, greater GS1 standard adoption is a natural solution.

GS1 labels: A standard for excellence

Companies that utilize GS1 labels comply with standards for what information is kept on barcodes—such as the weight of each case, or the quantity of cases. When you scan a GS1 barcode, you’ll know which, what kind, and how many of each product is located on the pallet. GS1 also provides standards for every step in the shipping process, including label placement and barcode color.

The challenge isn’t convincing warehouse operators to ship using GS1 labels—in fact, many warehouses receive shipments with GS1 tags on inventory, and many must place GS1 tags on items before they’re shipped.

Errors are likely to occur when warehouses place their own label on an item while it’s in inventory. This process not only wastes paper, but it also risks data loss or duplication. Because GS1 tags come with a unique identifier for the product and a unique serial number for each case that will never be duplicated, there’s no need for an internal barcoding system.

By adhering to GS1 standards, warehouses also improve traceability—a hot topic among supply chain innovators. Take, for instance, food manufacturers. Technology allows food and beverage suppliers to track every location a raw material has been during production. If there were to be an outbreak of food-related illness in a concentrated area, GS1 standards would provide manufacturers a common language to research and determine the contaminant.

Technology for a better supply chain

Today’s supply chain demands efficiency. As warehouses do more with less, demand rises for solutions that streamline operations. If you receive GS1-labeled inventory but maintain an internal barcoding system, it’s time to consider dropping the redundant process. If you don’t currently work with GS1 barcodes, consider moving to a system that helps improve inventory validity and traceability across your supply chain.

The layman might envision warehousing storage services as simply a very large storage unit where pallets of bulk shipments simply sit and wait.

Yourkey Warehousing professionals recognize that there’s much more to safe and efficient warehousing than a lot of building space. Savvy businesses find warehousing in highly accessibly areas, like Hong Kong, Shenzhen, Guangzhou, Shanghai, Ningbo and Xiamen so that goods are within quick reach of end users. But location access isn’t the only critical component of smart warehousing. Technology is key. Yourkey Warehousing has implemented a secure, state-of-the-art, web-based Inventory Management System, allowing you to view your inventories anytime and from anywhere. EDI and barcoding capabilities are included, which enables you to organize your resources and optimize your fulfillment and distribution processes. Keep track of everything from start to finish with this exceptional system.

There are more about our warehousing services as below.

Yourkey Warehousing Logistics

Contract, Public and Food Grade Warehousing

Full-Service Fulfillment

Container Unloading and Cross Docking

Pick and Pack, Repack, Sort and Segregate

Kitting and Assembly Services

Local and International Logistics

Distribution

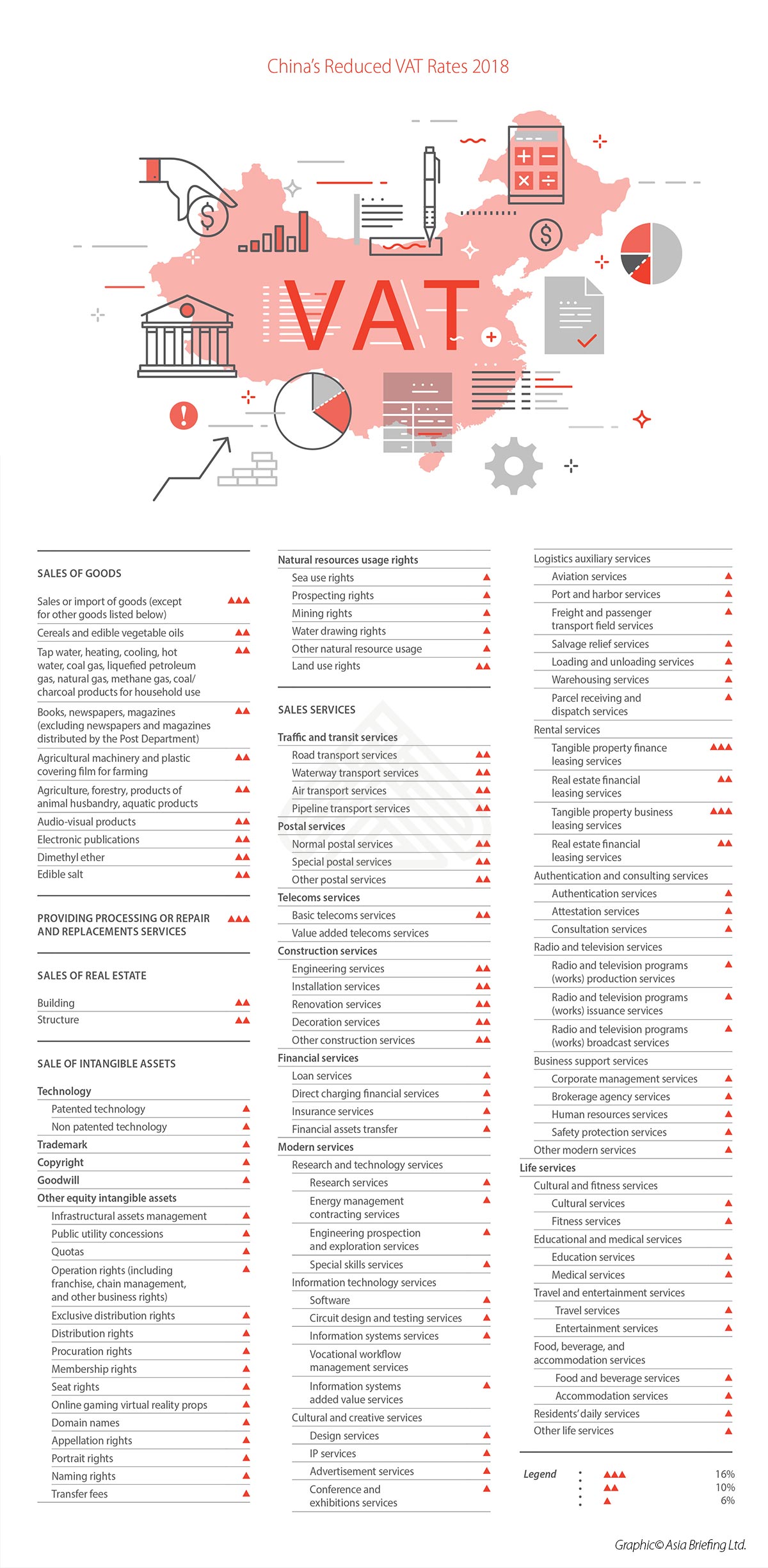

China recently lowered its value-added tax (VAT) rates, as part of an RMB 400 billion (US$64 billion) tax cut package.

The Ministry of Finance (MOF) and the State Administration of Taxation (SAT) recently released the Circular about Adjusting the Rates on Value-added Tax, which explain the details of the new VAT rates.

According to the circular, the tax cuts reduce the 17 percent VAT bracket to 16 percent, and the 11 percent VAT bracket to 10 percent. The six percent VAT bracket remains unchanged. The new VAT rates will go into effect on May 1, 2018.

The MOF and SAT also recently released the Circular about Unifying the Standards of Small VAT Taxpayers, which expands the criteria for firms to qualify as a small-scale VAT taxpayer. Small-scale VAT taxpayers are now defined as those whose annual sales are less than RMB 5 million (US$796,330). Before, there were three different tiers of small-scale VAT taxpayers.

The tax cuts are part of an ongoing effort to optimize the VAT system and reduce companies’ tax burdens. At the annual Two Sessions meetings in March, Premier Li Keqiang stated that the government aims to further streamline the VAT system by reducing the number of VAT brackets from three to two.

China’s updated VAT rates follow.

BACKGROUND

With a view to keep abreast with global, regional and national developments in moving towards electronic customs clearance and enable the industry stakeholders to submit electronic advance cargo information (e-ACI) to the Customs and Excise Department (C&ED), the Financial Secretary announced in the 2007-2008 Budget the construction of an e-ACI system to provide a seamless system for the movement and customs clearance of road cargoes aiming for trade facilitation and adequate risk profiling of road cargoes. The Road Cargo System (ROCARS) was officially launched on 17 May 2010 and became mandatory on 17 Nov 2011.

KEY FEATURES AND BENEFITS OF THE SYSTEM

All users of ROCARS must register with C&ED before they can submit the relevant information in ROCARS.

A shipper or a freight forwarder acting as a shipper (or an agent of either party) is obliged to submit a predefined set of cargo information to C&ED through ROCARS 14 days in advance or at least 30 minutes before the cargo consignment being imported or exported from Hong Kong by truck. The set of information consists of 8 items:

(a) Number of package;

(b) Description of package;

(c) Description of articles in each package;

(d) Name of consignor;

(e) Address of consignor;

(f) Name of consignee;

(g) Address of consignee; and

(h) Expected date of arrival / Expected date of departure

As an acknowledgment after successful submission of cargo information, ROCARS returns a Customs Cargo Reference Number (CCRN) for the cargo consignment to the shipper who should then pass it together with the cargo description to the relevant trucker. Not less than 30 minutes before the truck arriving at a land boundary control point ("LBCP"), the trucker should do the 'bundling' work through ROCARS (via the Internet or by phone(3902 3333 / 3153 2265)) providing (i) the CCRN of the cargo consignment and (ii) his vehicle's registration number to C&ED. The system will direct the trucker to cross the boundary immediately or after 30 minutes.

Under the operation mode of ROCARS, C&ED can perform risk profiling on the cargo before a truck arrives at an LBCP and determine in advance whether the cargo is required to be inspected.

The above arrangements enable Customs officers to conduct risk profiling on cargo consignment in advance, for determining whether a truck needs to be inspected. All cross-boundary trucks, except those selected for inspection, enjoy seamless customs clearance at the land boundary

Implementation of the system gives us added room to facilitate the passage of transshipment cargoes which involve inter-modal transfer (e.g. from land to air). For instance, land-to-air transshipment cargoes may normally be subject to customs inspection at either the LBCP or the airport, instead of having to be inspected at both control points, under the Intermodal Transshipment Facilitation Scheme (ITFS).

The importance of smooth cross-boundary traffic at all times is well recognized. ROCARS have resilience equipment and an off-site disaster recovery system to ensure its high serviceability in operation. To cater for the unlikely event of a total system failure, contingency plans have been put in place to ensure that the current manual mode of customs clearance could be switched on as soon as possible.

WAY FORWARD

Striking for the best, C&ED will refine ROCARS for providing better and speedier customs clearance service to uplift the competitiveness of Hong Kong as a logistics hub and facilitate the trade development in Hong Kong.

The China-Australia Free Trade Agreement (ChAFTA)

The ChAFTA, which came into force on 20 December 2015, marked a historic stride forward in economic cooperation between Australia and its largest trading partner, China. The agreement benefits a wide spectrum of sectors in Australia, and, in particular, it will phase in a series of tariff reductions for agricultural produce and processed food over the next few years. Most notably, the tariffs on beef, sheep and goat meat, dairy products and wines and spirits (which account for the bulk of Australia’s food export into China) will be progressively eliminated. Of these, beef and certain dairy products are subject to a discretionary safeguard if imports exceed an annual volume. These “safeguard” trigger volumes increase each year and have been set well above the highest historical annual export levels to China. Eliminating the tariffs places Australian food in an advantageous position compared with its competitors.

Strict food import regime

In the face of increasing food safety issues, the China Food and Drug Administration (CFDA) has introduced a scheme which requires manufacturers of imported food to register with CFDA and satisfy certain criteria before importing food. All importers and exporters of food to China are required to make a filing with CFDA. The regime currently covers almost all types of meat, aquatic products and dairy products. In 2016, CFDA further tightened control over baby formula products by requiring that all baby formulas be registered with CFDA. Each manufacturer may register up to 9 formulas. The registration requirements involve submitting robust materials to show that the criteria are met and, in some cases, onsite inspection by CFDA personnel is required. Several Australian food manufacturers have already registered with CFDA.

Shifting regulations on cross-border e-commerce

As the import regime gets tougher on foreign food, a rapidly growing volume of food finds its way into the Chinese market via cross-border e-commerce sales. The total transaction value of the China cross-border e-commerce market reached US$9.2 billion in 2016. Sellers and consumers in the online market are attracted by the low tariff rate and, more importantly, the exemption from the regulatory requirements applicable to traditional import routes into China, such as through registration with CFDA.

Since March 2016, the Chinese authorities have published a series of regulations aimed at extending normal import tariffs and regulatory requirements to goods imported into China via cross-border e-commerce channels. The new regime caused a backlash among the cross-border e-commerce sellers both in China and abroad and was put on hold indefinitely just a few days before Premier Li 's visit to Australia and New Zealand in March 2017. It is hoped that goods imported into China via cross-border e-commerce can continue benefiting from the low tariffs and regulatory exemption.

Australian food exporters have now entered a new era in selling food to China. In the face of regulatory challenges, the progressive elimination of tariffs benefits Australian food companies. For those who are more sensitive to the regulatory requirements, cross-border e-commerce has opened up a channel that allows Australian food exporters and manufacturers to sell directly to Chinese consumers. We would expect more and more Australian food sellers to seize the opportunities and the food sales to China to grow at an even faster pace in the coming years.

http://www.lexology.com/library/detail.aspx?g=551958c1-02f5-4a7f-95d9-76eb5a306ad8